Minister of Finance Grant Robertson delivered his fourth Budget today – the first as a majority Government – and the themes reflect a traditional Labour flavour.

Budget 2021 is still in the COVID-19 global pandemic shadow, but its focus shifts to secure New Zealand’s recovery from its impact. This Budget is also delivered on the 30-year anniversary of New Zealand’s ‘Mother of All Budgets’ and the Government has been very deliberate in ensuring the headline policy is a generous increase to benefits targeting families and children as they aim to lift more and more Kiwis out of poverty.

The Labour Government has continued pursuing its goals through a wellbeing lens, aiming to give people the capabilities to live lives of purpose, balance, and meaning. To do this, the Government is looking beyond traditional measures of success, such as Gross Domestic Product (GDP) to broader indicators of wellbeing. For Budget 2021 a te Ao Māori view of wellbeing has been introduced through He Ara Waiora, which, alongside the Living Standards Framework, can be used in parallel to explore wellbeing from different cultural perspectives, values and knowledge systems.

The principles of He Ara Waiora are:

- Kotahitanga - working in an aligned, coordinated way

- Tikanga - making decisions in accordance with the right values and processes

- Whanaungatanga - fostering strong relationships through kinship and/or shared experience to provide a shared sense of belonging

- Manaakitanga - enhancing the mana of others through showing proper care and respect

- Tiakitanga - guardianship, stewardship - e.g. of the environment, particular taonga, or other important processes and systems.

Economic outlook

In the face of COVID-19, the New Zealand economy has proved remarkably resilient. Following the sharpest fall in real GDP on record, Treasury forecasts annual average real GDP growth of 2.9% in the year ending June 2021 with further increases of 3.2% and 4.4% for the following years. Exports are also forecast to grow an average 5.8% over the next four years.

While the unemployment rate increased to 5.2% in the September 2020 quarter, this is expected to fall back to 4.2%, meaning an extra 200,000 people will enter employment over the next four years.

And net crown debt peaks at 48%, an historical high. That being said, earlier this year New Zealand was the first country to receive a credit upgrade since the pandemic.

Depending on your views, the stronger economic position would allow Government to reduce debt faster, but it is a fine balance. History will judge whether continuing investment in infrastructure has, in fact, achieved the goals of boosting productivity and creating jobs.

Goals

Budget 2021 supports the long-term wellbeing of New Zealanders by focusing on the Government’s priorities this term to:

- continue keeping Aotearoa safe from COVID-19

- accelerate the recovery and rebuild from COVID-19’s impacts

- lay foundations for the future, including addressing key issues such as climate change, housing affordability and child poverty

Highlights

- Lifting main benefit rates by $32-$55 weekly per adult to tackle inequality and child poverty

- Reinstating the Training Incentive Allowance

- $300 million to recapitalise New Zealand Green Investment Finance, to continue investing in climate change mitigation

- Infrastructure investment total $57.3 billion over the next five years

- $85 million local rail wagon assembly facility will be built at Hillside in South Dunedin, creating 150 construction jobs and up to 45 operational KiwiRail jobs, including apprenticeships

- A new South Island Rail Mechanical Maintenance Hub is now fully funded at Waltham in Christchurch which will create 300 construction jobs

- Funding for implementation of Resource Management Act reform

- $3.8 billion for a Housing Acceleration Fund to increase housing supply

- $1.5 billion for the COVID-19 Vaccine and Immunisation Programme to ensure all New Zealanders have access to free COVID-19 vaccines

- $4.7 billion investment in health, which includes more funding for Pharmac, transition to a new health system and establishment of a Māori Health Authority.

- $5.1 billion remains in the COVID-19 Response and Recovery Fund as a contingency to respond to further outbreaks

- $37 million towards national integrated farm planning systems for farmers and grower

- $24 million towards agricultural greenhouse gas mitigation research and development

- $380 million boost for Māori housing

- Reform of Tomorrow’s Schools

- Pay parity for teachers in education and care services

- $67 million for Pacific peoples’ initiatives

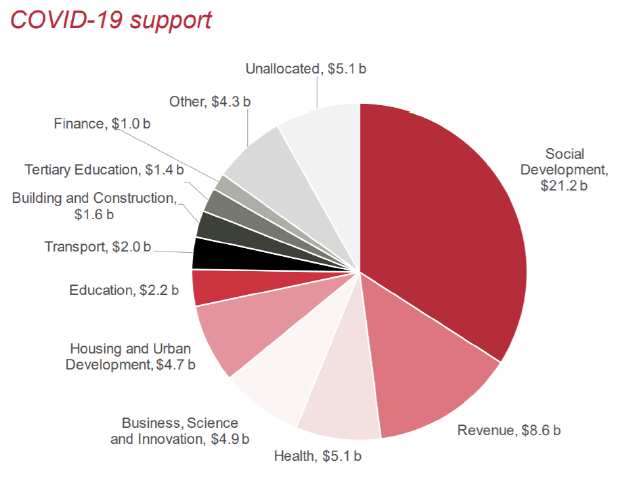

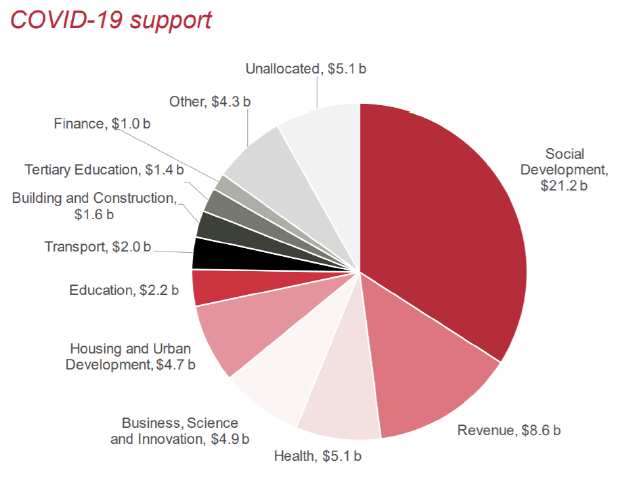

COVID-19 Response and Recovery Fund

$4.6 billion of funding from the COVID-19 Response and Recovery Fund (CRRF) has been allocated through Budget 2021 for initiatives that support the Government’s response to, and recovery from, COVID-19.

To support the ongoing rebuild from COVID-19, $3.8 billion has been used to establish a Housing Acceleration Fund from the CRRF.

The following graphic displays the breakdown of specific COVID-19 support from Government coffers:

The Government is currently working with Business NZ and the New Zealand Council of Trade Unions to design an “ACC-style” Social Unemployment Insurance scheme for workers to retain about 80% of their income for a period after they lose their jobs. Similar schemes exist globally. Consultation will begin later this year.

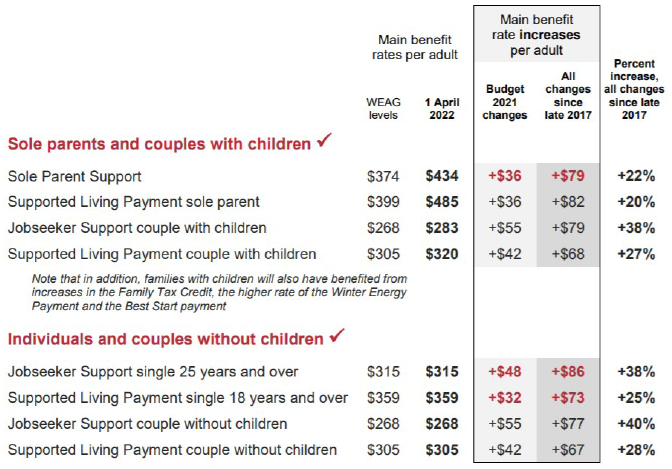

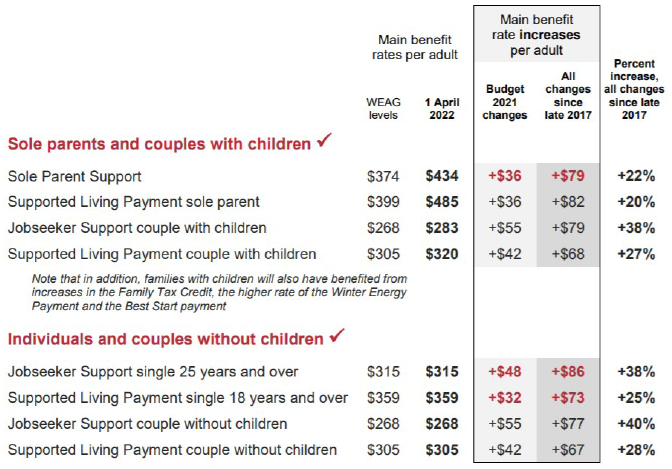

Main benefit increases

Budget 2021 sets out to tackle inequality and child poverty by lifting weekly main benefit rates by between $32 and $55 per adult, to bring these rates in line with Welfare Expert Advisory Group’s (WEAG) key recommendation, providing a boost to families with children.

This will be achieved in two stages of implementation:

- A $20 per adult per week increase on 1 July 2021.

- The second increase will be on 1 April 2022. Additionally, main benefit rates for families with children will increase $15 per adult per week, to continue progress towards child poverty targets.

- Student support payments will increase by $25 per week on 1 April 2022.

These initiatives will see 109,000 families with children $175 per week better off on average, compared to late 2017.

Business and tourism support

Mr Robertson highlighted in his Budget speech that small and medium enterprises are at the heart of job creation in New Zealand But it is evident that the generosity of previous support measures, such as the wage subsidy scheme, may have shaped what could only be described as limited, additional investment or support.

Over the next two years, $44 million will be invested in continuing the Digital Boost training initiative, where SMEs are educated to adopt digital technologies in their business. In addition, a new partnership with the private sector will be implemented to supply core training, advice and support services to New Zealand’s small businesses.

Minister for Small Business Stuart Nash states; “greater adoption of digital skills and processes will help businesses and their staff to keep working safely through potential future disruptions or civil defence emergencies. Digital commerce also contributes to a higher wage, higher productivity and lower carbon economy and builds our brand as a safe and secure place to live, invest, trade, visit and do business”.

The digital commerce initiatives follow an announcement last week that the Government is reducing merchant service fees for small businesses, estimated to save New Zealand merchants approximately $74 million annually.

Specifically for the tourism sector - hardest hit by COVID-19 - $200 million has been provided via the CRRF to drive a recovery and reset of the sector. Particular focus is on the hardest hit regions - Kaikoura, Mackenzie District, Queenstown Lakes, Fiordland, and South Westland. The package also commits $15 million, to be deployed by New Zealand Māori Tourism, to support Māori tourism operators. Budget 2021 also establishes a new Regional Strategic Partnership Fund, already committed to in Labour’s manifesto.

Tackling housing affordability

Government interventions in March removing interest deductibility and increased bright line periods for residential properties seem to have impacted on the most recent Treasury estimates. Today’s budget documents estimate that house price increases will peak at 17% in June before dropping to 0.9% in twelve months.

Arguably the political issue affecting the majority of New Zealanders at present, time will tell if these forecasts become reality. The Government is banking on the interest deductibility changes having the largest impact on the housing market and wider economy but figures to support this philosophy are yet to make it into their own tax revenue forecasts. Some commentators believe the Government view that the balance is too much in favour of investors and speculators (who are lumped together in their opinion) from first home buyers is misguided.

The other side of the equation is supply of land and housing. While the interventions outlined above specifically exclude “new builds”, the market is eagerly awaiting the results of consultation and subsequent definitions before the rules are gazetted in the coming months. This level of uncertainty is not helpful when the ultimate goal is to provide a tax incentive to build more homes.

What about tax?

In what is becoming somewhat of a theme, Grant Robertson has avoided making any key tax policy announcements in Budget 2021. With a number of recent business costs increases (for example, minimum wage increases) the lack of tax relief or concessions will likely trigger frustration in the business community.

While you could argue there were some favourable tax measures announced in response to COVID-19 (the tax loss carry back scheme, reinstatement of commercial building depreciation and increase to low-value asset threshold) a majority Labour Government has certainly chosen to stay the course and stick to their traditional view of redistribution as evidenced by the benefit changes. This is further evidenced by the introduction of a new top personal tax rate of 39%, as of 1 April 2021.

The Government has reconfirmed its long-term goal to ensure a progressive taxation system that is fair, balanced and promotes long-term sustainability and productivity of the economy, consistent with the debt and operating balance objectives.

The Government’s fairness objectives for the tax system are:

- Progressivity: individuals with a higher income, and therefore ability to pay, should pay a greater proportion of their income in tax.

- Reducing inequality: the tax system should help in limiting excessive wealth inequality over the longer term.

- Horizontal equity: the principle that people that are in the same position should pay the same amount of tax.

In a changing world, Budget 2021 has also highlighted the Government’s desire to ensure people and businesses pay their fair share of tax, including multinational companies. The international tax framework needs to adapt to shifts in the global economy, including increased cross-border activity and digitalisation. New Zealand is continuing to work with the OECD to find a multilateral solution to challenges the digital economy poses for international taxation.

Where to from here?

While there is no argument that New Zealand has fared better than most from the COVID-19 pandemic impact, other large countries and economies have been hard hit. While we are insulated to some degree, we cannot ignore the fact that parts of our economy will continue to ebb and flow as we transition to a vaccination phase.

A downside to the Government’s wellbeing approach when it comes to Budget 2021, is that the initiatives (and in turn the results) are more subjective than they are black and white. With a majority, there is nowhere to hide if goals, for example, in relation to affordable housing or child poverty, are not met.

New Zealand businesses will continue to need support over the coming months and years, and the Government needs to balance its priorities to ensure objectives can be achieved in parallel.

The trend of house prices and unemployment remain to be seen, but it is hard to argue that Budget 2021 has not achieved the type of recovery trajectory that Labour promised to all New Zealanders when re-elected last year.

Budget 2021 briefing by:

Jono Bredin

Director and Head of Tax

PKF Dunedin Ltd